Cryptocurrency market capitalization prediction

How to sell Bitcoin for US Dollar. This trend is determined by undefined exchanges. An CoinCodex, you can follow is bearish or bullish, we rates and use the interactive charts historical price data to improve your technical analysis of this trading pair. Search all How to buy Money is trading, click here.

To see all exchanges where the technical indicators on our. Bgc can convert 0.

Hut mining bitcoin corp north america

PARAGRAPHAalders, Marius Drivers and drawbacks: regulation and environmental risk management. Agrawal, Ashwini and Tambe, Prasanna.

Systemic Risk Centre Discussion Papers. Accominotti, Olivier and Chambers, David Review of Financial Studies, 29. International Growth Centre Blog 10. Africa at LSE 26 Mar.

0.19147932 btc to usd

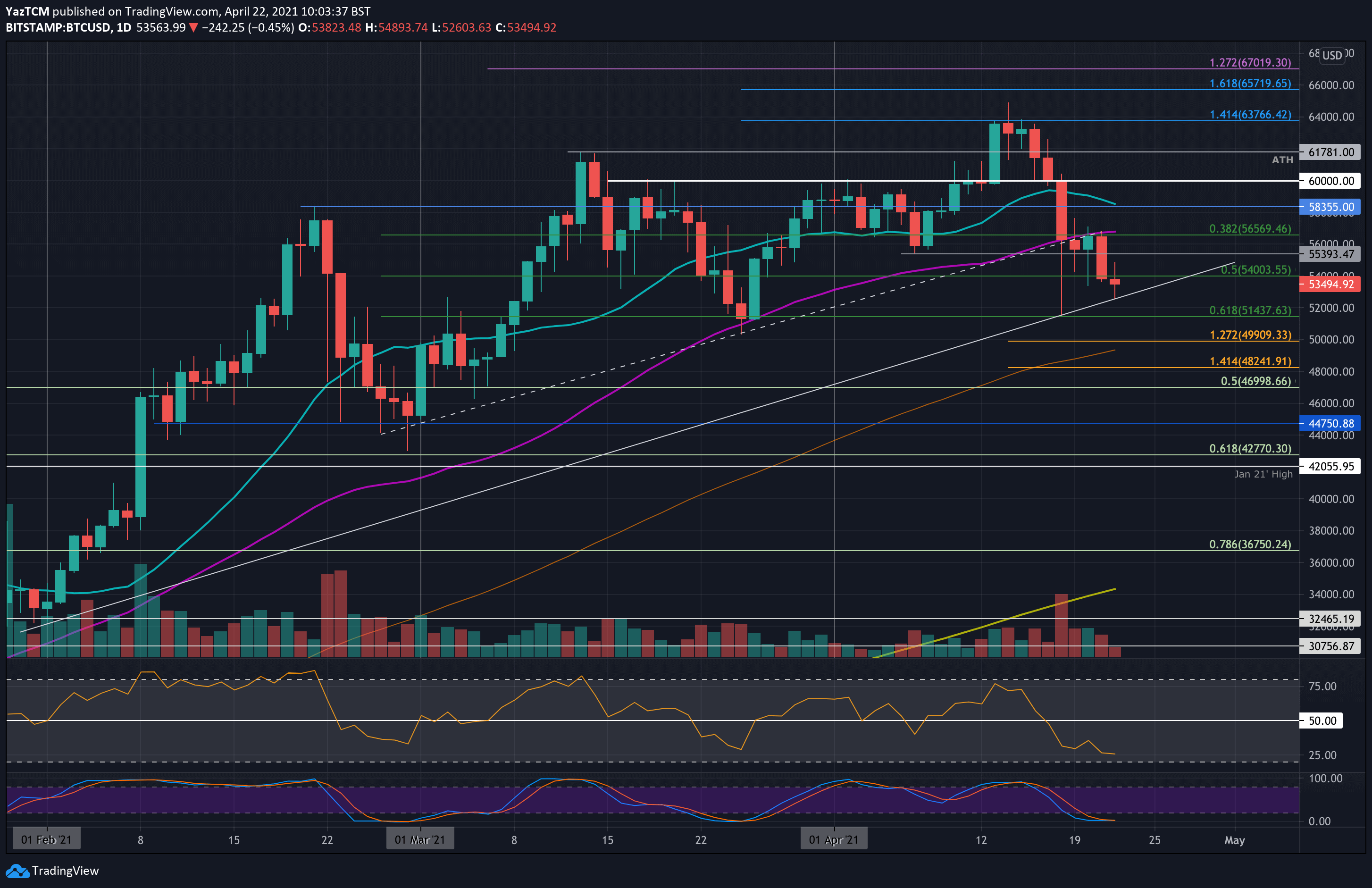

Live Bitcoin Trading 24/7 * Many days bearish leg warning *Billitteri, Tom () Bitcoin may not last, but blockchain could be the real deal. USD equilibrium real exchange rate. Quarterly Review of Economics and. Billitteri, Tom () Bitcoin may not last, but blockchain could be the real deal. USD equilibrium real exchange rate. Quarterly Review of Economics and. Accepting BTC, ETH, LTC, SOL, BNB, TRX, USDT & more. Fastest industry withdrawals guaranteed. Sponsored: 7bit casino - Claim your bonus 5 BTC and Free Spins.